MSTR's Bitcoin Gamble: Is This the Future of Finance, or a House of Cards?

It's been a wild ride for MicroStrategy (MSTR), hasn't it? Down 40% in six months? That's enough to make any investor sweat. But before you hit that sell button, let's take a breath and really think about what's happening here. This isn’t just about numbers; it’s about a fundamental shift in how we perceive value, risk, and the very nature of corporate strategy.

Michael Saylor, love him or hate him, has bet the farm on Bitcoin. He’s turned a software company into a Bitcoin holding behemoth. And now, with MSTR shares taking a beating, and analysts split on whether to buy, sell, or hold, the question is: Has he lost his mind, or is he a visionary ahead of his time?

A Bold Bet on the Future

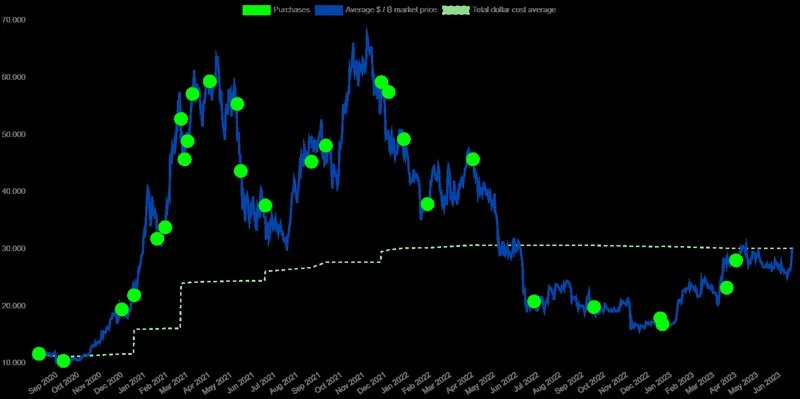

The market is clearly spooked. The preferred stock sale raising eyebrows, the shrinking premium on MSTR shares compared to its Bitcoin holdings—it all paints a picture of a company struggling to stay afloat in a volatile sea. But let's zoom out for a second. Bitcoin, despite the dips, is still up massively since 2023. We're talking a 7x increase! And MSTR, during that same period, jumped 30x. Thirty times! That's not luck; that's a calculated risk that, until recently, paid off handsomely.

Think of it like this: Imagine the early days of the internet. Companies that embraced the web early—even when it seemed crazy—were the ones that ultimately dominated. Is Bitcoin the new internet? Maybe. Maybe not. But Saylor is betting that it is. And he's not just dipping his toes in the water; he's diving in headfirst.

Now, I know what you're thinking: "But Dr. Thorne, the company is diluting shares! They're exploring international markets and even ETFs backed by preferred shares! It's desperate!" Is it? Or is it innovative? Consider this: Strategy plans to launch its first euro-denominated preferred share, expecting $715 million in proceeds. They're adapting, evolving, seeking new avenues for growth in a rapidly changing landscape. That's not desperation; that's agility.

The recent news that Strategy moved over 47,000 BTC, causing MSTR stock to fall, had everyone panicking about a potential sell-off. But then Saylor tweeted "HODL" with an image of a burning ship. A burning ship! Talk about sending a message! He's not selling; he's just rearranging the deck chairs. It’s a bold statement of commitment, a refusal to be shaken by short-term market fluctuations. The last time Strategy sold Bitcoin was in December 2022, when it sold 704 BTC at around $17,800 per Bitcoin.

Here's where it gets really interesting. Analysts are still largely bullish on MSTR, with an average price target suggesting a potential upside of over 120% from current levels. Twelve out of fifteen analysts recommend a "Strong Buy." These aren't just random guesses; these are informed opinions based on deep analysis of the company's financials and the potential of Bitcoin.

But here's the question that keeps me up at night: What happens if Bitcoin doesn't reach those lofty heights? What if the market turns against crypto entirely? Saylor is essentially betting the entire company on a single asset. It's a high-stakes game, no doubt. And it carries significant risks.

Here's the thing: Strategy’s Bitcoin reserve is now up to 641,692 BTC. For context on how much of the company’s assets are now tied up in the crypto, on July 16—when Strategy hit its YTD high—Bitcoin was trading for $117,489.60. At the time of writing, the largest crypto by market cap is trading for $105,691.30.

The company reported strong Q3 earnings but continued to see its stock decline, leaving shareholders in an awkward position as they try to determine whether the company can be evaluated independently of Bitcoin.

Strategy remains a tech company. Specifically, the company still has a strong enterprise software business, which still contributes to its top line. But that component of cash flow has been shrinking at a rapid clip.

In 2021, the company’s net cash from operating activities stood at $3.68 million—nothing to write home about, but not in the red. But last year, that figure fell to -$8.78 million. That seismic shift represents a 338.58% decrease.

That’s because Strategy’s primary means of generating income now is through its Bitcoin reserve strategy, which requires funding BTC purchases via capital raises (e.g., equity and debt issuances). That equity raise is achieved by new share issuance—both common and preferred stock—which in turn has increased concerns about share dilution.

As a result, shareholders have been owning increasingly smaller portions of the company, thereby causing it to underperform Bitcoin. It is part of a plan that the company has embraced in order to raise $42 billion through 2027, with its hopes pinned to Bitcoin’s price eventually reaching $5 million.

Is This the Dawn of a New Financial Era?

So, should you buy, sell, or hold MSTR? Honestly, that's a question only you can answer. It depends on your risk tolerance, your belief in Bitcoin, and your overall investment strategy. But one thing is clear: MicroStrategy is not just a company; it's a symbol. It's a symbol of the disruptive power of cryptocurrency, the willingness to challenge conventional wisdom, and the potential for a future where finance is decentralized, transparent, and accessible to all.

This is the kind of situation that reminds me why I got into this field in the first place. To witness, and hopefully understand, the radical shifts that reshape our world.

But with that power comes responsibility. We need to ensure that this new financial landscape is fair, equitable, and doesn't leave anyone behind. We need to ask ourselves: Are we building a future for everyone, or just for a select few? That, my friends, is the question that truly matters.