Buffett's Google Gamble: A $5 Billion Bet or a $3 Trillion Validation?

Alright, let's break down this Berkshire Hathaway move into Alphabet. The headlines are screaming about Warren Buffett finally "buying Google," but the reality is a bit more nuanced than that. It’s not just about the size of the position, but what it signals, and even that signal is open to interpretation.

Berkshire scooped up approximately 17.85 million shares of Alphabet (GOOGL) (GOOG) by the end of Q3 2025, a stake valued around $4.93 billion. That’s a hefty chunk of change, no doubt. But in the context of Alphabet's $3.3 trillion market cap, it's only about 0.3% of the company. Big number, small piece of the pie.

Parsing the Pivot

The interesting angle here isn't the absolute dollar amount, but the relative shift within Berkshire's portfolio. They trimmed their Apple (AAPL) stake from 280 million shares to roughly 238.2 million during the same period. This suggests a rebalancing act, a bet that Alphabet's growth prospects outweigh Apple's at current valuations. It is a big deal, considering Buffett historically treated Apple more as a consumer brand, and Alphabet as a tech play.

But is it Buffett himself making this call? The articles mention his impending departure as CEO at the end of 2025 and the presence of portfolio managers Todd Combs and Ted Weschler. Buffett typically handles the larger positions, but details on who specifically initiated this Alphabet buy remain scarce. It matters because Buffett's reputation carries significant weight.

This move is being framed as a validation of Alphabet's AI and cloud strategy. The company is sinking $40 billion into data centers in Texas alone by 2027. That’s a massive commitment, but it also raises questions about return on investment. Alphabet guided for $91-93B in 2025 capex, and some analysts are starting to sweat about AI returns being over-hyped.

And this is the part of the report I find genuinely puzzling. On the one hand, analysts are nearly unanimous in their "Buy" or "Strong Buy" ratings for Alphabet. The average GOOGL stock price target stands at $312.29, implying a 12.98% upside from the current price. On the other hand, you've got regulatory headwinds looming, including the DOJ's ad-tech case and ongoing antitrust scrutiny in Europe. The potential forced sale of their AdX exchange could definitely cut into operating leverage.

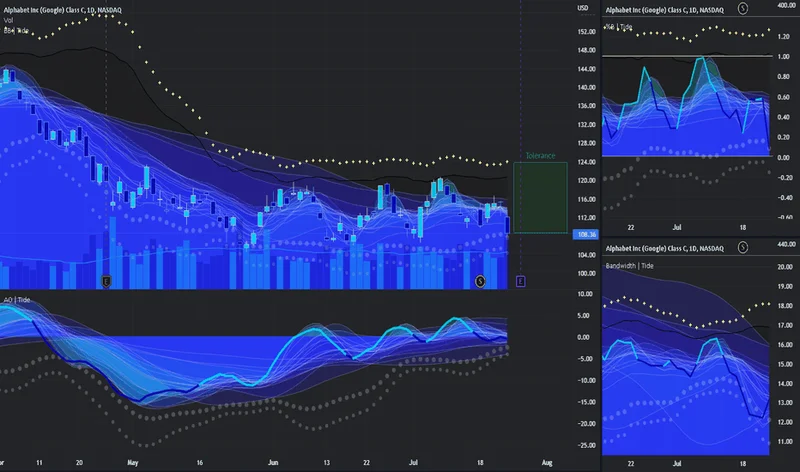

The market's reaction has been interesting. The initial "Buffett pop" saw GOOGL shares jump 5-7% in after-hours trading, but that surge quickly cooled as traders locked in profits. This suggests a degree of skepticism, a sense that the Buffett endorsement is priced in – or that traders are not really sure what to do with the news. Google Stock Rises 5% after Berkshire Hathaway Adds $5 Billion Position

Antitrust Thorns

Speaking of regulatory risk, the German court ruling ordering Google to pay €572 million for abusing its dominance is another data point to consider. While the direct financial hit is manageable (Alphabet pulls in over $100 billion in quarterly revenue), it adds to the narrative that Alphabet's market power is under increasing pressure. It's a "manageable guardrail" now, but could be a bigger constraint as Google tries to extend its dominance into generative AI.

Let's not forget the fundamentals. Alphabet's Q3 2025 earnings were solid: revenue of approximately $102.3 billion, up about 16% year-over-year. EPS came in at $2.87, beating consensus by roughly 25%. Google Cloud revenue is scaling rapidly, growing ≈34% YoY to around $15.2 billion. The company is a cash-generating machine. This is all happening while also paying out a dividend of $0.21 per share, which is an annualized yield of about 0.3% at current prices.

The question is, how much of this is already baked into the stock price? With a P/E ratio of ~27x forward earnings, the market is already expecting continued growth. If regulatory pressures or slower-than-expected AI monetization start to bite, that multiple could contract quickly.

Buffett's Backing: A Bandaid or a Boost?

So, what's the real takeaway? Buffett's investment is undoubtedly a vote of confidence, but it's not a blank check. The core issues – regulatory risk and the uncertain ROI of massive AI investments – remain. Whether this "Buffett bump" turns into a sustained rally depends on Alphabet's ability to navigate these challenges, and that's a calculation even the Oracle of Omaha can't guarantee.